Key Differences Between Savings and Checking Accounts Explained

Learn the main differences between savings and checking accounts, including features, interest rates, and transaction limits. Discover how each type can match your financial goals and how to effectively manage both for optimal money management.

Understanding How Savings and Checking Accounts Differ

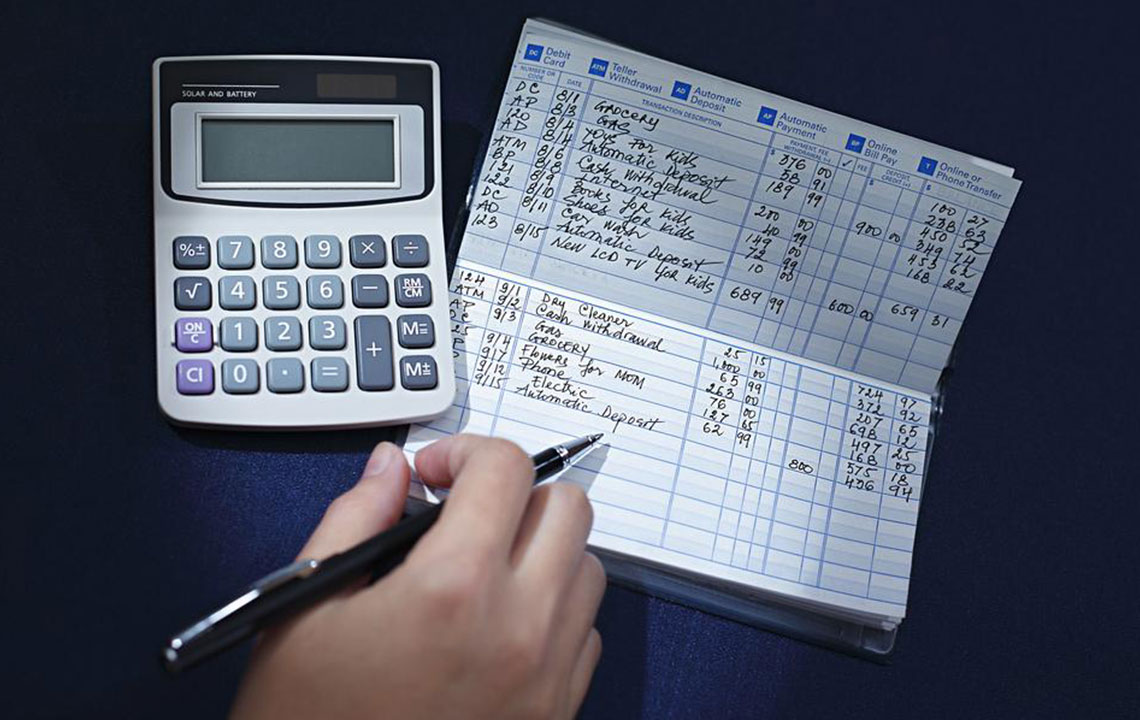

Choosing between a savings account and a checking account can be confusing. Checking accounts are designed for everyday transactions, offering quick access to funds, check writing, and online payments, but usually earn little to no interest. Savings accounts focus on long-term savings, encouraging higher deposits while earning more interest. They limit transaction frequency to promote saving. Both accounts serve distinct financial needs and can be used together to optimize your financial management.

Before selecting an account, consider features like fees, minimum balance requirements, and transaction limits. Checking accounts often have lower withdrawal limits but enable unlimited spending and quick online access. Savings accounts typically limit withdrawals but provide better interest rates on deposits. Debit cards are usually linked with checking accounts for convenience, while savings accounts offer limited transaction options. Maintaining both accounts helps balance liquidity with earning potential for your finances.

Important Notice:

This article offers general financial insights based on research. Always verify specifics with your bank, as terms vary. Use the information as guidance, not definitive advice. We are not liable for differences across institutions or missed promotions. For personalized financial planning, consult a professional advisor. Our goal is to help you make informed financial choices safely.