Top Practical Tips for Smarter Financial Planning

This article offers practical financial planning tips, including building emergency funds, budgeting, investing wisely, and utilizing tax benefits. These strategies help individuals improve savings, achieve financial goals, and ensure long-term security through consistent effort and smart financial habits.

Top Practical Tips for Smarter Financial Planning

Building savings can be challenging, but regardless of age or profession, adopting simple financial habits can help you reach your monetary objectives long-term. Starting early and staying consistent are essential for success.

Here are effective strategies to improve your savings and financial health.

Create an Emergency Fund

Setting aside a portion of your income to build a safety reserve enhances your financial security. Contribute regularly to grow this fund over time.

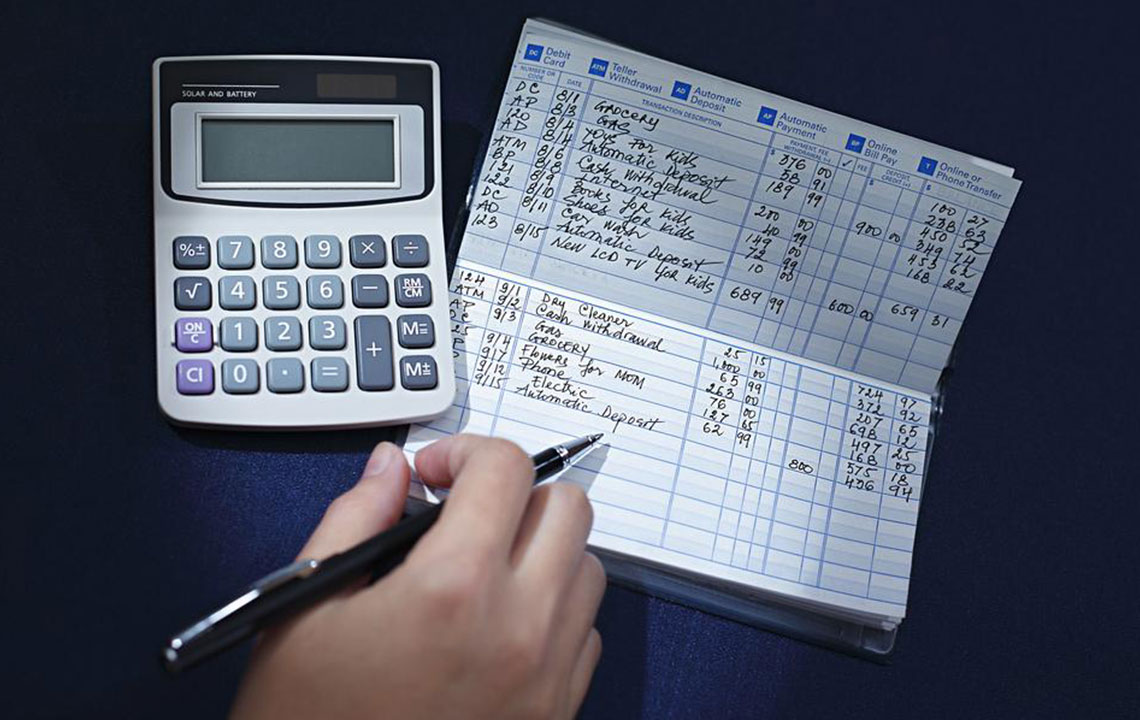

Implement and Follow a Budget

Careful planning of your earnings and expenditures is vital. Track your spending, cut unnecessary expenses, and review your budget periodically to stay aligned with your goals.

Prefer Cash or Debit Cards Over Credit Cards

Using cash or debit helps monitor spending and reduces debt risk, unlike credit cards which may encourage overspending without immediate consequences.

Invest for Future Growth

Beyond just saving, consider investing in stable options that offer growth prospects. Utilizing savings accounts and diversifying investments can optimize your returns over time.

Set Realistic Short-term Savings Targets

Start with manageable goals like saving for a vehicle or initial home costs rather than only focusing on retirement. Consistent monthly contributions foster solid savings habits.

Maximize Tax Benefits

Take advantage of employer-sponsored plans such as retirement accounts (e.g., 401(k)). Use tax refunds wisely and avoid unnecessary early withdrawals.

Following these straightforward financial habits can help individuals build wealth and secure their financial future. Consistency remains the key to achieving your savings and investment ambitions.