Ultimate Overview of Vehicle Spare Parts Industry

This article provides a comprehensive overview of the vehicle spare parts industry, covering OEM and aftermarket components, market trends, and distribution channels. It highlights industry challenges, market dynamics, and the growth of online sales, offering valuable insights for stakeholders and consumers alike.

Ultimate Overview of Vehicle Spare Parts Industry

The vehicle parts manufacturing sector plays a vital role in the automotive market, with demand primarily driven by new vehicle sales. Around 70% of parts manufactured are original equipment manufacturer (OEM) components, while the remaining 30% are aftermarket parts used for repairs and customization.

The global economic slowdown in 2008 affected car sales worldwide, impacting major automakers like Ford, GM, and Chrysler. International brands had already begun to capture significant market share in the domestic space prior to the downturn, gradually surpassing domestic manufacturers.

In September 2008, spare parts suppliers faced rising raw material costs alongside decreasing demand. Post-recession analysis suggested that profitable operation required about 80% capacity utilization; however, in 2009, actual use dropped to 50-60%. Vehicle spare parts are divided into aftermarket components and original equipment (OE) parts.

OE parts are used during vehicle assembly, supplied through service networks, and are organized into three levels. Tier 1 suppliers deliver finished parts directly to automakers; Tier 2 sources raw materials or components for Tier 1; Tier 3 manufactures raw materials or parts for Tiers 1 and 2, sometimes selling directly to car manufacturers. OE manufacturing accounts for roughly 66% to 75% of total vehicle parts production.

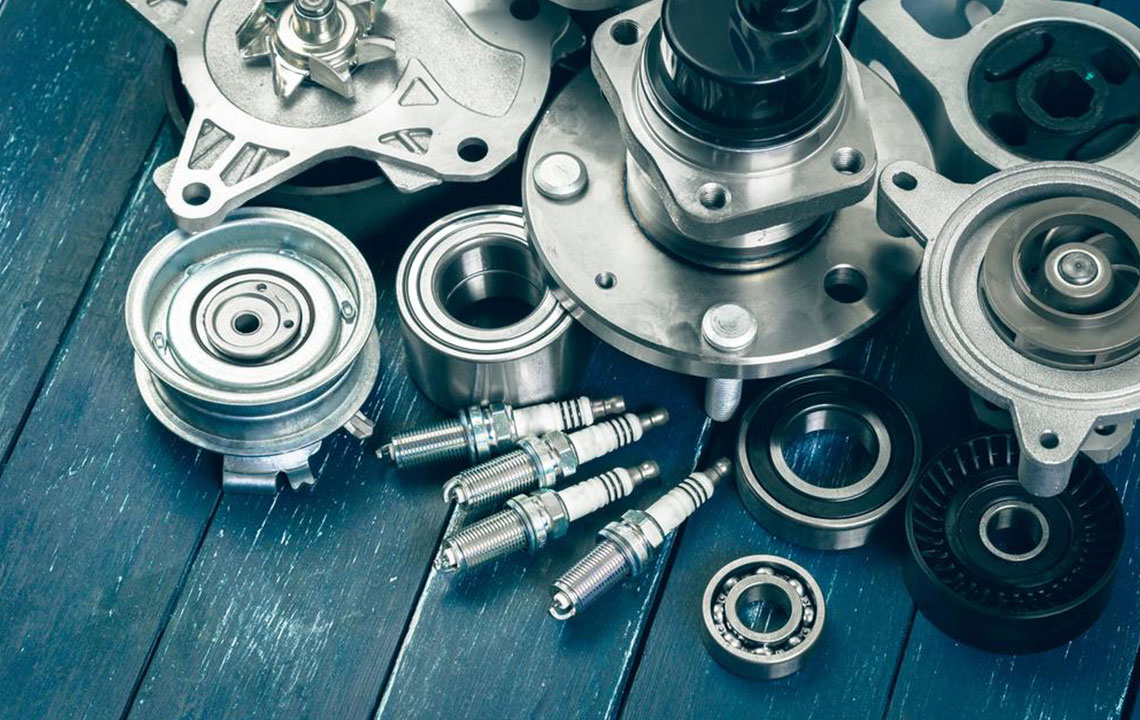

Spare parts fall into two categories: accessories, which improve performance, comfort, safety, or aesthetics, and replacement parts, which are remanufactured or built to substitute worn or broken original parts.

Consumers today can buy locally or online. Top e-commerce platforms like Amazon and eBay Motors dominate aftermarket parts and accessories sales, with online revenue expected to reach $10 billion by 2018, excluding used parts and auction sales.