Differences Between Debit and Credit Cards Explained

This article explains the differences between debit and credit cards, highlighting their features, benefits, and security aspects. It emphasizes responsible usage to maximize benefits and ensure safety. Ideal for consumers seeking to understand their payment options and manage finances effectively.

Key Differences Between Debit and Credit Cards

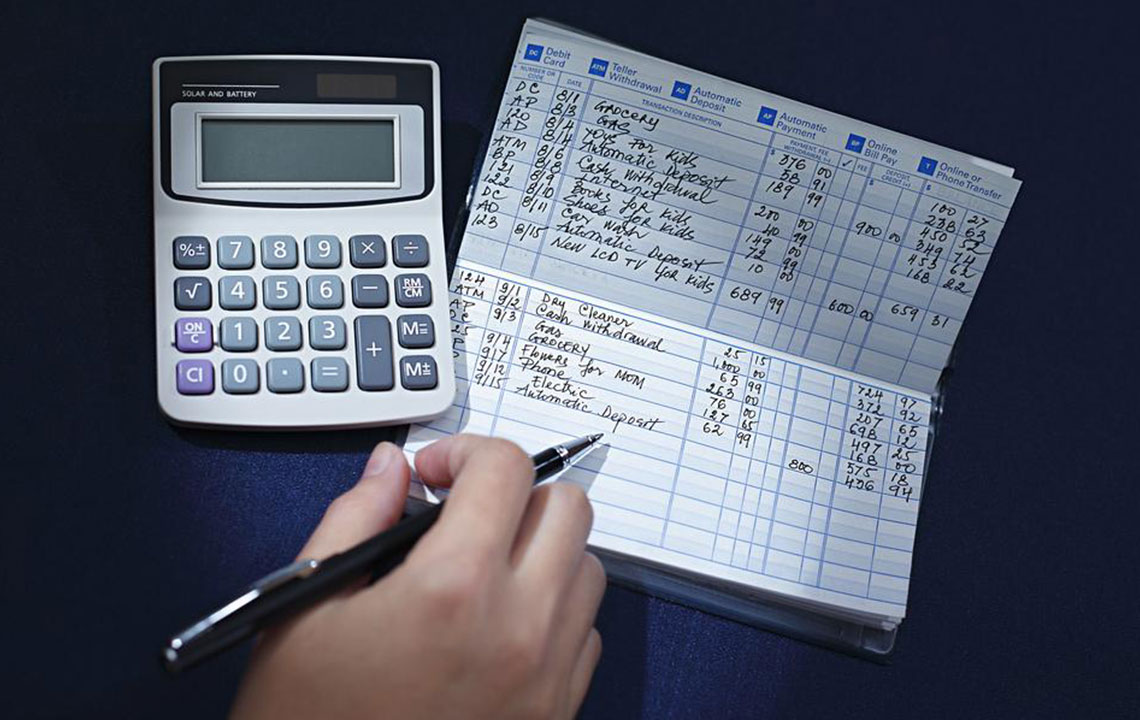

Having a debit or credit card is nowadays standard, and often necessary for daily transactions. These cards feature a magnetic strip for identification and a unique 16-digit number for processing payments.

Debit vs. Credit Card Comparison

Debit cards issued by banks allow direct access to your funds in savings or checking accounts, supporting a cashless lifestyle. Credit cards, on the other hand, are available after credit approval and provide a borrowing facility from the bank.

The main difference is that debit cards utilize your own deposited money, whereas credit cards let you borrow from the bank up to a certain limit, to be repaid later.

Benefits of Using Debit and Credit Cards

Debit cards encourage prudent spending and help avoid debt, making them suitable for those wary of overspending. Meanwhile, credit cards come with perks like rewards, cashback offers, and travel points, adding value for users.

Responsible use of credit cards can also positively impact your credit score, aiding in financial health.

Security Features of Debit and Credit Cards

In case a debit card is lost or stolen and misused, the funds in your account are immediately affected, and recovering the money can be time-consuming. Credit cards can usually be blocked quickly once reported lost, minimizing potential losses and safeguarding your finances.

Both card types offer benefits, but responsible handling is essential for security and maintaining good financial standing.