Top 5 Tools for Simplified 1099 Tax Filing for Self-Employed Professionals

Discover the top 5 user-friendly tools for 1099 tax filing tailored for self-employed professionals and freelancers. These solutions simplify form preparation, printing, and e-filing, ensuring compliance with IRS requirements. Ideal for independent contractors managing their own taxes, these options include features like data import, print-ready forms, and electronic submission. Trusted providers like HR Block, TaxRight, and Staples offer reliable software packages, making tax season less stressful. Stay organized and compliant with the best tools designed for small business owners and freelancers.

Leading 1099 Tax Preparation Solutions for Freelancers and Contractors

Running your own business offers flexibility, but also entails specific tax duties, especially when handling 1099 reporting. Independent workers and contractors must be aware of how their earning structure affects tax filings.

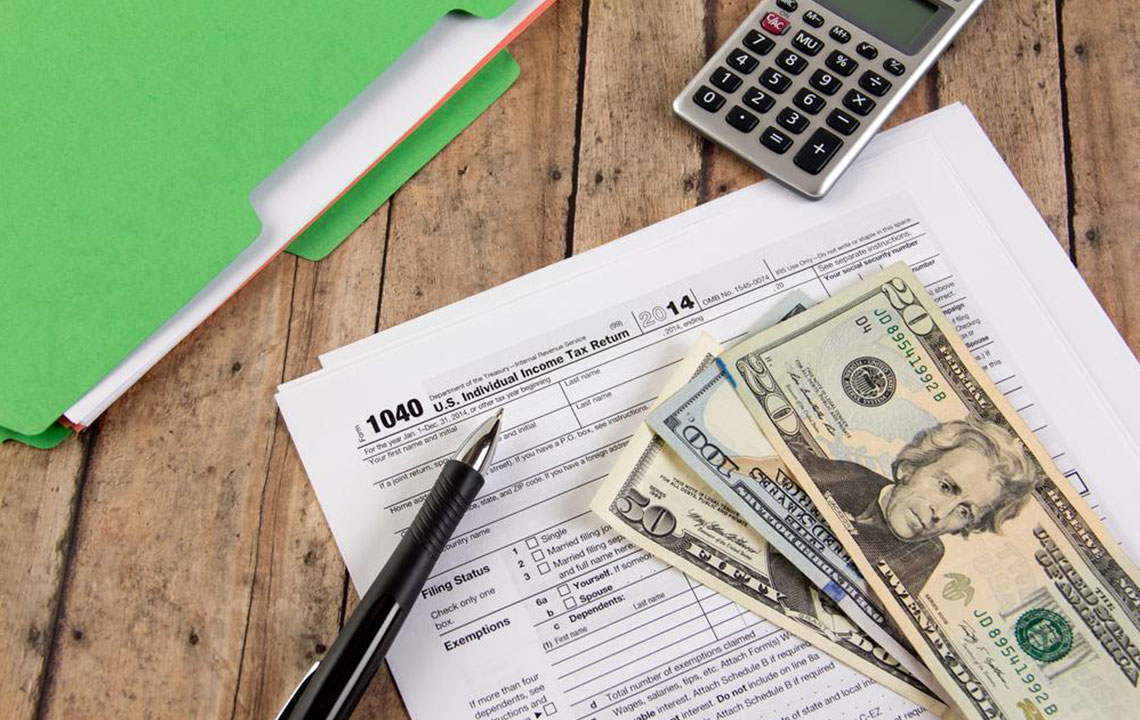

The IRS mandates the submission of 1099 forms to report various income types paid to non-employees or independent contractors.

It is the payer's duty to file the 1099 form. If a business pays an independent contractor or another entity $600 or more within a year, they must issue an IRS 1099.

Utilizing specialized 1099 software streamlines the filing process for individuals and companies. When choosing a software, consider these essential features:

Data Import – The software should support importing data from CSV, Excel, or text files and convert different formats into a compatible version.

Form Printing – Ability to generate official IRS documents like Copy A and Form 1099 suitable for laser printing.

Electronic Submission – Support for e-filing forms such as 1099, 1098, 3921, making submission quicker and more efficient.

Trusted providers like HR Block, TaxRight, Staples, TOPS, LaserLink, and ComplyRight offer dependable 1099 filing options. Here are some recommended choices:

Staples® 2018 1099-MISC Forms Kit – Perfect for filing 1099-MISC, compatible with Adams Tax Forms Helper and compliant with regulations.

TaxRight™ 1099 MISC 4-Part – Includes 25 laser forms, self-sealing envelopes, and 10 free e-filings for multiple recipients.

H&R Block 2018 Premium Software – Provides guided instructions, supports importing data from TurboTax and Quicken, easing the filing process.

ComplyRight™ LaserLink XL – Allows 200 free e-filings for various IRS forms, with options for manual entry or import via templates.

TOPS® 1099MISC Kit – Contains laser forms and envelopes, compatible with Adams Tax software helper, enabling efficient form printing and submission.

Note: Our article offers general guidance on 1099 software options. For specific advice or recent updates, consult a tax expert. We are not responsible for discrepancies or recent changes beyond this overview.